hawaii capital gains tax increase

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Hours later the Senate Ways and Means.

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

The table below summarizes uppermost capital gains tax rates for Hawaii and neighboring states in 2015.

. Uppermost capital gains tax rates by state 2015 State State uppermost rate. Effective for tax years beginning after 12312020. The Grassroot Institute of Hawaii would like to offer its comments on SB2242 which seeks to create additional tax brackets thus raising the states top income tax rate from.

The US state of Hawaii may overtake California as the state with the highest income tax rate in the country under legislation slated for a vote this week. Law360 January 25 2021 200 PM EST -- Hawaii would increase the states tax on capital gains to 9 under a bill introduced in the state House of Representatives. Analyze Portfolios For Upcoming Capital Gain Estimates.

An increase in the capital gains tax is likely to discourage entrepreneurship and investment two things that could help grow the economy and create jobs. The following testimony was submitted by the Grassroot Institute of Hawaii for. SB2485 cites tax fairness in proposing state capital gains tax increase.

Contact a Fidelity Advisor. Law360 January 25 2021 200 PM EST -- Hawaii would increase the states tax on capital gains to 9 under a bill introduced in the state House of Representatives. The state House on Thursday approved bills to raise the inheritance or estate tax and also voted to increase the state capital gains tax.

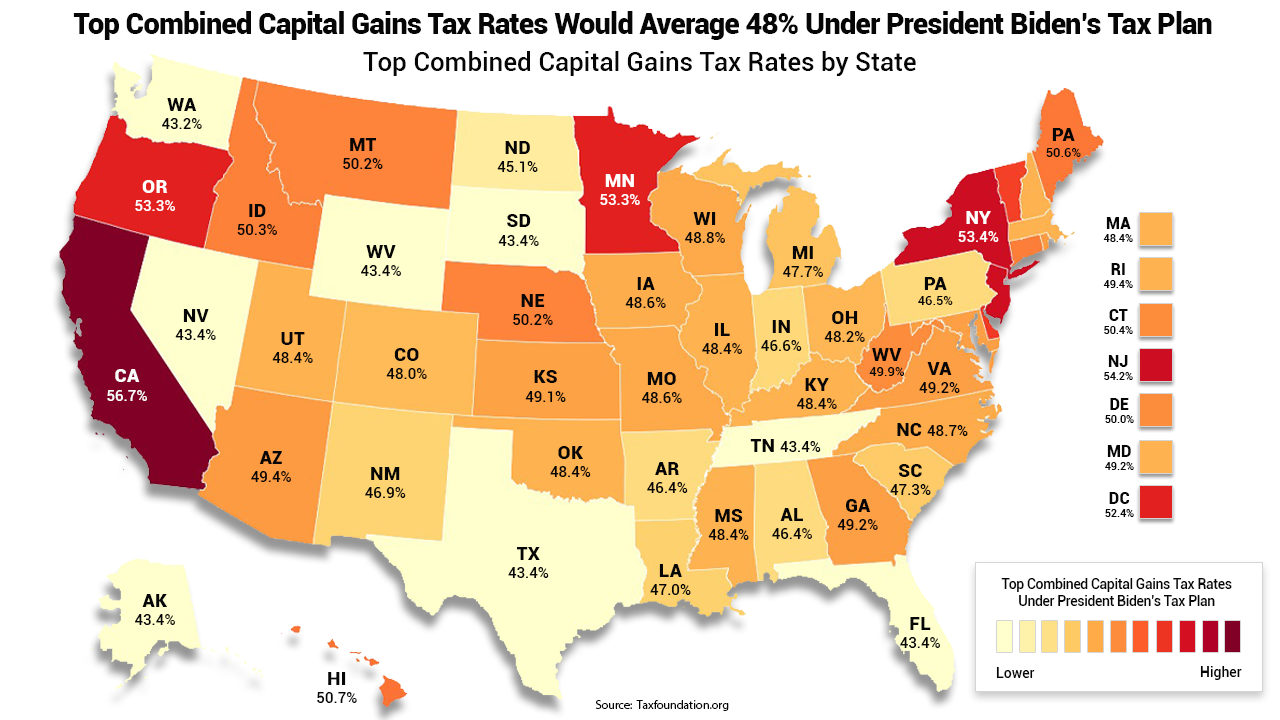

The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. Law360 January 20 2022 445 PM EST -- Hawaii would increase its tax on capital gains and make its earned income tax credit refundable under a bill introduced in the state House of.

The summary description of legislation appearing on this page is. Increases the capital gains tax threshold from 725 per cent to 9 per cent.

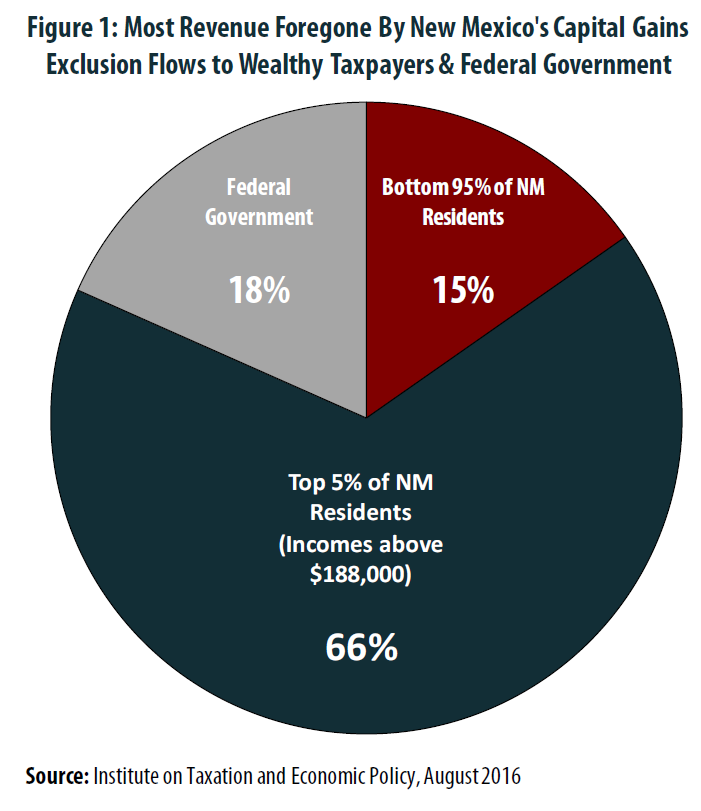

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

How Regular People Can Pay Less Taxes Like The Rich And Powerful

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

Capital Gains Tax Rates By State Nas Investment Solutions

The Price Of Paradise Hawaii Considers Nation S Highest Income Tax Rate Marketwatch

The Folly Of State Capital Gains Tax Cuts Itep

Capital Gains Tax Calculator Estimate What You Ll Owe

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Tax Fairness Is Popular And Needed For Hawaii S Future Hbpc

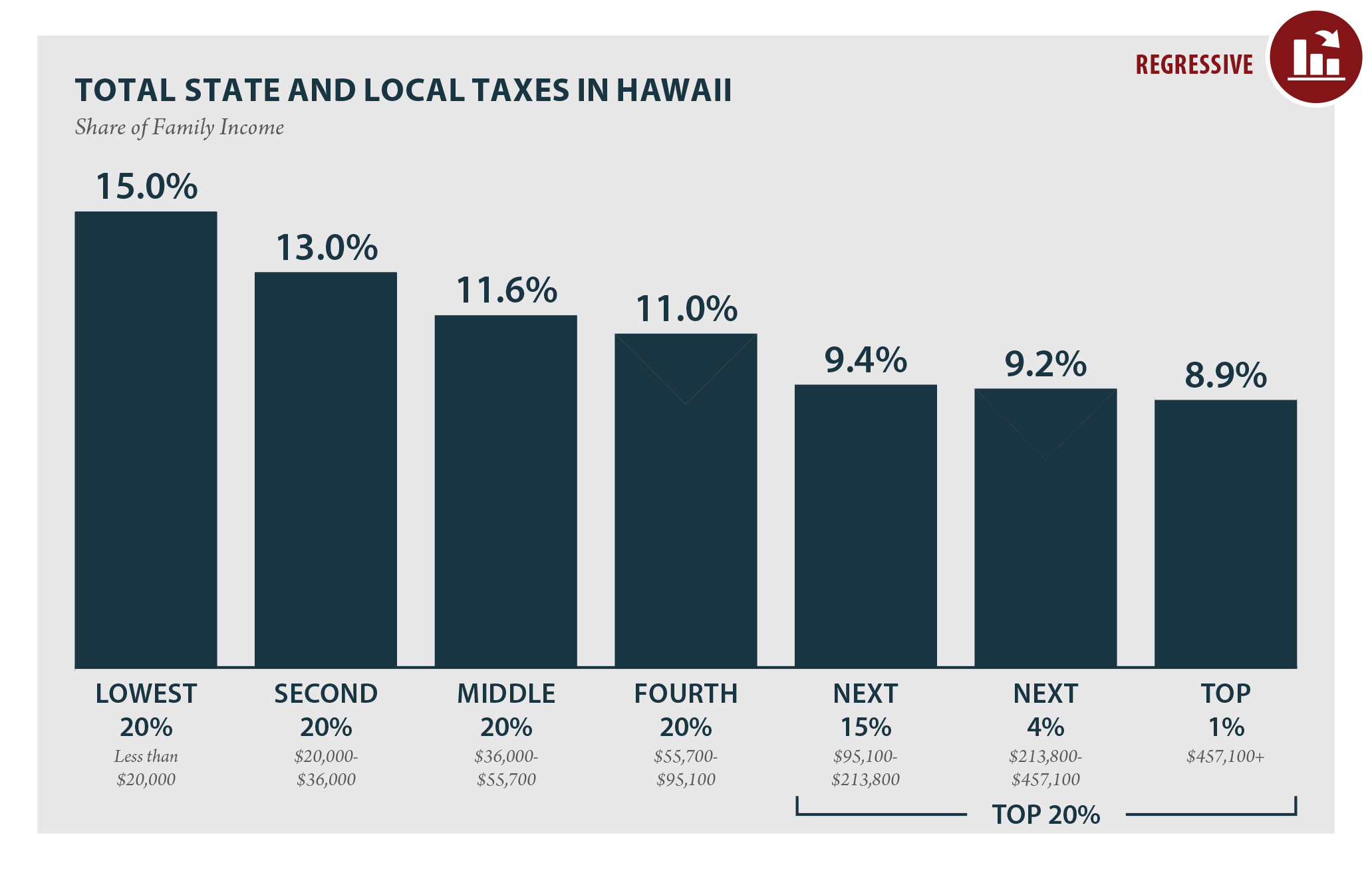

Hawaii Who Pays 6th Edition Itep

New Capital Gains Tax By Property Type

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Testimony On Hb1507 Tax Fairness Really Means Tax Increase Grassroot Institute Of Hawaii

Mapped Biden S Capital Gain Tax Increase Proposal By State

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition